NOTE: Please do not enter confidential information in the chat box. NAVIE does not provide answers that would require typing in sensitive data information from its users.

Be Ready to Discover a Different Way of Finance Support!NAVIE is known as the Finance Virtual Assistant. It is developed to provide you instant support on finance space. Currently, we have developed several use cases built and with your support, we train Navie to have its knowledge and scope grow continuously

Chat with NavieStart chatting with Navie by typing in your question or selecting from one of the use-cases. To better understand each of them, you can go through the list.

|

Information and Services at your fingertips

Training Navie If you require any support or experience any issues with Navie, please send an email to: BNG-WIPSHGFBAMNSAPSUPPORT@shell.com |

|

FO Contact

You may also start the conversation with Navie by typing the below message:

|

NOTE: Please do not enter confidential information in the chat box. NAVIE does not provide answers that would require typing in sensitive data information from its users.

|

Travel & Expense

|

|

Time Writing

Our chatbot is designed to simplify and streamline the process of time entry and cost recovery for Shell staffs. With this chatbot, you can conveniently record your daily work hours, allocate time to different projects or tasks, and ensure accurate cost recovery for your services. NAVIE will help you to look for answers via the FAQs for Time Writing. You may ask Navie for FAQs related to:

Type in your error message popped on SERP portal while time writing, Chatbot can assist to resolve the error by instructing you on taking necessary steps. Time must be accounted for on a day-by-day basis, ensuring that target hours are fully accounted. It is essential that time writing is complete, accurate and timely to ensure that customers are billed correctly and in time to enable us to recover our costs. All P&T staff (In P&T legal entities), and all contractors and contract staff (*) working and under direct P&T/UI supervision, are required to account for their time. |

|

Tax Sign-off of Power of Attorney (POA)

By working through Navie’s questions and updating your POA accordingly, Navie will usually be able to provide you with Tax sign off via email. If Navie is unable to provide sign off, for example where the POA is to be exercised in one of a limited number of “high risk” countries, Navie will direct you to an appropriate local Country Tax Adviser to assist you The Tax sign off will not be valid if the responses you provide are not accurate or the POA has not been amended in line with Navie’s advice, and you will need to upload the final POA to a SharePoint site (as directed by Navie) in order to validate the Tax sign off. Please also be aware that Navie will capture certain details about your Line of Business and Location for the advice and responses to be audited, which will contribute to our assurance processes and Navie’s ongoing development. |

|

FAQ in Information Management

Information is a valuable asset and integral to Shell's business operations. Business decisions and performance depend heavily on the effective

use and exchange of information, both within Shell and with business partners, customers, suppliers and other external parties. Our people develop

their competencies and knowledge by using information |

|

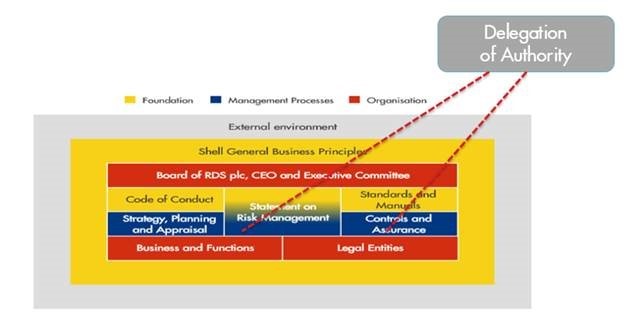

FAQ in Manual of Authority

In each category, there will be list of sub categories to minimize your search. Please select the most relevant sub category based on your query. The Delegation of Authority process is one of the key control processes of the Shell Control Framework . The Group has an integrated, consistent process to delegate authority from the Royal Dutch Shell and other Shell company boards to organizations, individuals and committees. The principal delegated authorities are documented in Manuals of Authorities (MoAs). These help to ensure that actions in the key business processes are taken with the appropriate authority. This process recognizes the distinction between organizational authorities (related to the Group’s internal organizational structure) and corporate authorities (related to legal entities). |

|

|

|

Learning from Incident

Incident Management including Learning from Incident (LFI) is an important process component of the Shell Control Framework, which is designed to provide reasonable assurance that Shell will meet its business objectives and fulfil its external obligations and commitments. Incidents are unplanned events caused by control breakdowns. The objective of incident management is to identify and disseminate lessons learnt more widely that will enable the implementation of actions to reduce the risk of future control breakdowns and thereby improve performance over time. |

|

International Marine Lubes Tax

The VAT and excise duty treatment of marine lubricants is a complex subject. With different rules applying in each country, it can be difficult to know whether or not tax is chargeable on any given supply. This is a particular challenge for the International Marine - the Shell Marine Products Concos supply customers in many different countries around the world. Whether setting customer expectations when ordering in a new port location, or dealing with an invoice dispute, it is important that Shell presents correct and consistent information to customers or other stakeholders. Navie is able to confirm details of the taxes to be invoiced to International Marine customers for an into-vessel supply of lubricants to the vessel nominated in the sales order. Currently Navie is able to help with supplies made within Europe* – additional countries will be added in due course. (*Belgium, Denmark, Finland, France, Germany, Greece, Italy, Malta, the Netherlands, Norway, Poland, Romania, Spain, Sweden, UK). Navie will ask you to provide the following details for the order or invoice: selling entity, port location, customer type, end use type, vessel destination. Based on this information, Navie will indicate the tax treatment, together with details of any certificates or licences required from the customer. If the scenario is complex, Navie may direct you to the Tax Focal Point for International Marine for further detailed guidance. If your query does not relate to an into-vessel supply in the indicated countries, please contact the Tax Focal Point for International Marine at SBSC-Marine-Indirect-Tax-queries@shell.com |

|

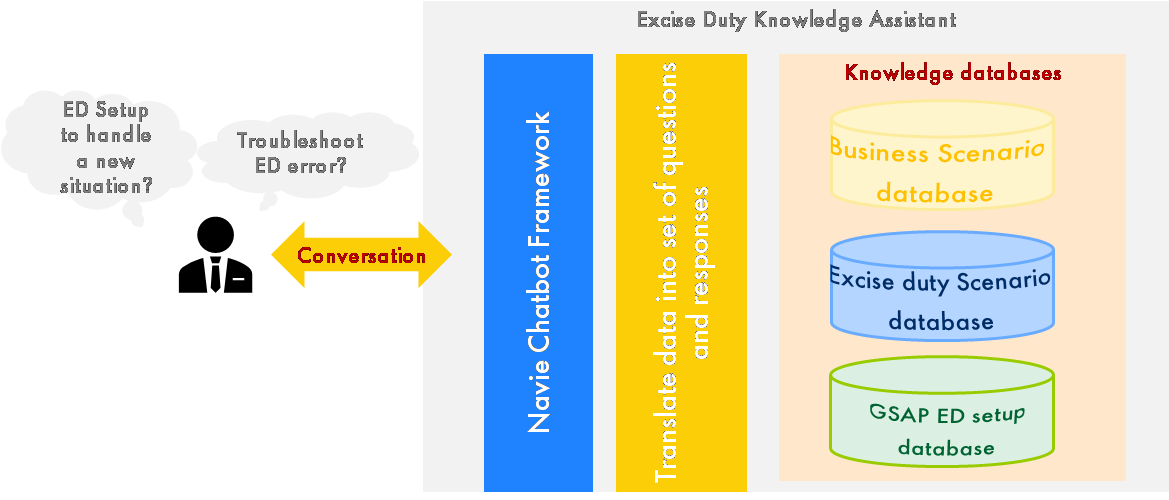

Excise Duty Knowledge Assistant

Excise Duty Knowledge Assistant (EDKA) in Navie provides detailed advice on Excise duty (ED) solution and its setup in GSAP. ED solution in GSAP is controlled through several master data and configuration tables objects in GSAP. What is to be set up, for which objects and how varies by business scenarios and tax regimes. Missing or wrongly updating any of that cause either ED errors or incorrect results. In addition to that wrong business and tax data in the transaction and processing transactions for new unsupported scenarios also causes error. The reason of the error as given in the error message is usually not the object and the only object in GSAP requiring update or correction. Fixing the reason given in the error message will eliminate that error but will usually result in another error or cause error with some other scenario or be the cause on incorrect ED determination in that or another scenario. Hence it is very important to investigate the situation and get to root cause before taking any action. EDKA can get to the root cause of your problem/issue and advise you on actions required for resolving it. For this it will ask you several questions to investigate your situation before providing advice. There can be several setups possible to fix a problem situation. EDKA will provide the standard that keeps the solution setup simple. Always follow the advice and if that does not resolve the problem then reach out to process expert as listed in the useful links below. Useful links:

|

|

|

|

Risk & Controls

Navie tool will directly or indirectly assist to ensure data integrity and effective risk management in digitalization and encourage the information flow by advising or answering any queries from business or functions related to digital risk and controls. In case you can’t find answer to your query, you can log in your question in query repository Query Repo and our digital risk experts will revert to you within three business days. This will also help fix the confusions caused due to receiving slightly different answers when asked from different individuals on the same topic. With so much information available around digital risk management, individuals miss to track information about the ongoing activities in digitalization. Though the information is readily available, often it is unclear to individuals where to reach out to get the right information, when they feel stuck in digital initiatives Navie can assist you on your queries related to Risk, Controls and Assurance principles which includes but not limited to:

Effective controls are integral to managing the business and to sustaining its performance. Controls are operated throughout Shell in all Businesses and Functions at various levels. They range from ongoing transactional checkpoints designed into systems and processes to regular management reviews. Controls are continuous, structured activities or mechanisms that help ensure that Businesses and Functions achieve their objectives, including compliance with legal and regulatory requirements. In short, they modify risks. In Shell, several policies and guidance are implemented to ensure that proper risk-based approach to the design and operation of fit-for-purpose controls. |

|

Director Appointments

Navie can provide this advice and sign off in relation to most companies (excluding Royal Dutch Shell itself) as long as Shell has at least 50% ownership. Some countries are outside of Navie’s remit, and if Navie is unable to provide sign off for any reason then you will be directed to an appropriate Tax Focal to assist you. The key tax risk in relation to Director appointments or Directors dialling in to Board meetings from overseas is that the tax residence of the company might inadvertently “migrate” based on where the Directors are carrying out their activities. To assess this risk, Navie will ask a series of questions about your company and the location of the Director(s). Based on your answers, Navie will cross reference the tax residence tests of the country where the company is located and the country where the Director is based, and will advise on whether there is a risk and how this can be mitigated. When responding to Navie, please ensure you read the questions and requirements carefully. The Tax sign off will not be valid if the responses you provide are not accurate or the conditions stated in the Tax sign off email are not adhered to. Please also be aware that Navie will capture certain details about your Line of Business and Location in order for the advice and responses to be audited, which will contribute to our assurance processes and Navie’s ongoing development. |

|

FAQ in Corporate Controllers

The Corporate Controllers team provides controllership and finance-in-the–business services to the Parent, Holdings and Treasury, Pension & Insurance Companies. It also includes a team that manage the planning and financial reporting for the Corporate sector. Furthermore, all UK Country Controller activities and responsibilities also fall within the Corporate Controllers team. The scope of departmental activities covers:

Corporate Controllers provide financial management support to Shell Foundation |

|

End User Computing

End-User Computing(EUC) refers to use-cases that are built by people outside of the formal software development processes (sometimes referred to as citizen coding). Such use-cases are usually built-in applications that provide a high level of flexibility and configurability in the way the use-case is built and operates. Why EUC ControlsEUC applications are not subject to the same rigour in development, monitoring and control as traditional applications and are consequently more vulnerable to errors. To address the risks associated with the introduction of EUC, it is expected that these EUCs adhere to specific best practices laid out by the EUC team. |

|

STR High Level VAT guidance

NAVIE confirms whether or not or under which conditions STR involvement in a cross border supply chain is allowed, not allowed or allowed subject to further conditions. The VAT treatment for trading related supply chains is a complex area. With different rules applying in each country, it can be difficult to know whether or not a potential involvement in a supply chain can be supported under the current set up of STRs tax position in Europe. This is a particular challenge for the STR Trading desks. Aligning on VAT requirements before entering into a deal is crucial in order to meet supplier and customer expectation with regards to VAT complaint invoice, settlement process and VAT compliance. NAVIE is able to not only help to find out whether STRs involvement in a cross border supply chain is allowed, not allowed or allowed subject to further conditions but can also provide details in potential DEX entries for Tax load and Tax discharge fields needed to ensure correct VAT determination in DEX and thus supports STR VAT compliance. Currently NAVIE is able to support domestic transactions in EU countries, intra-EU movements as well as import and export deals. NAVIE will ask you to provide the customs status of the products you plan to buy or sell, the load location, the discharge location as well as the incoterm agreed with the supplier and the customer. Based on this information, NAVIE will indicate whether STRs involvement in a cross border supply chain is allowed, not allowed or allowed subject to further conditions, together with details needed to be manually entered into DEX tax load or DEX tax discharge field in order to ensure correct VAT determination in DEX. If the scenario is complex, NAVIE may direct you to the Tax Focal Point for Product Trading for further detailed guidance. If your query does not relate to a cross border supply chain, please contact the Tax Focal Point for Product Trading SSSC-MIT006-TAX@shell.com |

|

Finance Operations Fit4 Tool

Fit4 Tool Reference Guide Fit4 is a standardized Shell application to manage initiative portfolios. It is designed to enable delivery teams to manage and drive their initiative projects to completion, and to support the site improvement journeys, which connect to the overall Finance Operations targets and goals. Fit4 provides a central view of the opportunity funnel across entire hierarchy for all businesses, ensure consistency across the organization, streamline support and training and require users to learn a single tool and skill that is transferable across CoBs. Fit4 supports the critical need for consistency, transparency and visibility across all COBs to maintain competitiveness. How Fit4 Works? – As a Tool

Funnel Management Platform in Salesforce designed to manage a broad portfolio of initiatives as part of

a wide-ranging value capture program

How Fit4 Works? – The Ways of Working

Take Strategy to Plan - Aligning leadership and gap to potential, confirming focus areas,

aligning targets, prioritizing planning & resourcing and creating initiatives and workstreams

|

|

DIY Development

We will continuously improve the information we can provide through NAVIE as we learn more about frequently asked questions about DIY by the FO community. What is DIY?DIY (Do-IT-Yourself) Development, often known as Citizen Development, is a critical trend in industry, delivering significant and rapid cost savings for companies. DIY is picking up speed in Shell, with more businesses and functions requesting information and wanting to start their DIY Journey. DIY Software Development allows end users to solve business problems quickly and safely using digital solutions they have built themselves. This will also increase the ‘Employee Value Proposition' for Shell, attracting new talent looking for progressive, technically advanced companies. How can we safely unleash this potential in Shell and by so doing, generate significant business value?

As DIY is for everyone, with or without software development experience, we encourage you to explore DIY and learn how you can contribute to Shell’s Digitalization Journey. |

|

India Tax Virtual Advisor Here the support would cover a wide range of both India tax Direct and Indirect tax aspects. To name a few, the quick list is as under – Direct Tax

More categories would be added on a going forward basis. We would be happy if you find the India Tax Virtual Advisor useful for your work and would be looking forward to hear feedback / suggestions on how we can further enhance the overall performance of India Tax Virtual Advisor. |